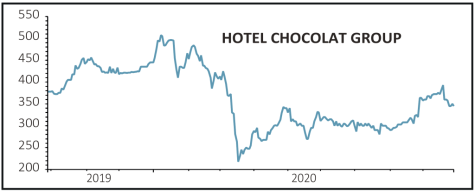

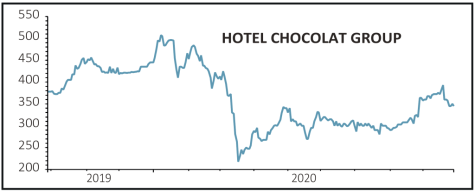

HOTEL CHOCOLAT (HOTC:AIM) 345p

Loss to date: 18.5%

Original entry point: Buy at 423.5p, 19 December 2019

Despite a rebound since March, shares in Hotel Chocolat (HOTC:AIM) are still 18.5% below our original entry price.

A strong brand with global aspirations and huge online potential, Hotel Chocolat has ample liquidity to navigate through the remainder of the crisis and could be a winner this Christmas as buying a nice box of chocolates via the internet is an easy

present idea.

Results for the year to June reflected the disruption to second-half trading caused by the pandemic, which led to the closing of all UK retail locations for 12 weeks including the busy Easter period and an eight-week factory shutdown.

Adjusted pre-tax profit of £2.4 million was better than the £1.8 million forecast by some analysts.

As at 20 September, it had net cash of £16.5 million and liquidity headroom of £51.5 million.

Digital demand is said to be up over 150% over the first 12 weeks of the new financial year and the US and Japan, two of the world’s largest gifting markets, ‘look to be progressing nicely’ according to broker Peel Hunt, ‘which is testament to the fact that the brand travels’. The US is experiencing strong digital growth and this should be accelerated by a new e-commerce partnership signed with The Hut (THG).

SHARES SAYS: We’re staying positive on Hotel Chocolat for its global and online growth allure and strong liquidity buffer.

‹ Previous2020-10-01Next ›

magazine

magazine