Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

M&A fever in the supermarket sector after Morrisons bid

Surprise news that supermarket group Wm Morrison (MRW) had been approached by US private equity firm Clayton, Dubilier & Rice with a £5.5 billion bid, sent the shares 30% higher on 21 June and has sparked a frenzy of speculation in the wider groceries sector.

CDR, which was advised on its bid by former Tesco (TSCO) boss Sir Terry Leahy, is no stranger to the UK retail scene having acquired B&M European Value (BME) in 2013 before taking it public in 2014.

Morrison’s board, led by chairman Andrew Higginson and chief executive David Potts, by coincidence two of Leahy’s closest lieutenants during his reign at Tesco, rejected the 230p per share bid on the basis it ‘significantly undervalued Morrisons and its future prospects’.

GAINS FOR SOME, PAIN FOR OTHERS

While major shareholders in Morrisons such as Silchester (15%), Threadneedle (7.4%), Majedie and Schroders (SDR), both with holdings of just under 5%, were busy celebrating, the hedge fund community was licking its wounds at the 30% price spike.

Morrisons is one of the most shorted stocks in the FTSE 100, with 5.7% of its outstanding capital on loan. Major short sellers include BlackRock (2.29%), Pelham (1.65%), Citadel (0.73%), GLG Partners (0.53%) and Third Point (0.5%) according to data collected by ShortTracker. Shorting involves taking a position to benefit from the share price falling.

Rival supermarket group Sainsbury’s (SBRY) is the most shorted stock in the main index, with four of the five fund managers short Morrisons replicating their bet while Marshall Wace (1.29%) and KPS (0.68%) are also on the list of short sellers. Sainsbury’s shares jumped 4% to 271p on 21 June, their highest level since 2019.

CHEAP CASH COWS

While sales have started to normalise following a year of spectacular growth during the pandemic, the supermarkets are still prodigious generators of cash thanks to their negative working capital model (they get customers’ cash before paying suppliers) making them highly attractive to private buyers.

Earlier this month the regulator nodded through the £6.6 billion takeover of Asda – the UK’s third-largest grocer by market share – by the Issa brothers and private equity backer TDR Capital. Results for the year to March show former owner Walmart took almost £3 billion in dividends before the handover.

Despite a sharp fall in return on capital in the year to January, caused by a net cash outflow of £450 million due to lower fuel sales, lower profits and higher inventories, Morrisons still increased its full year pay-out by 27% and paid a special dividend. CDR will be rubbing its hands at the prospect of a recovery to a more normal level of cash flow this year.

SALES STAGNATING

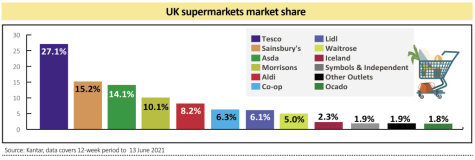

To illustrate the slowdown in sales, according to the latest data from consultancy Kantar, the UK grocery market shrank by 1.6% in the 12 weeks to 13 June 2021 compared with 2020, although sales were still £3.3 billion higher than the same period in 2019.

Take-home food sales are down on 2020 as last year’s lockdown prompted a huge jump in demand for eating at home, added to which the number of shoppers fell during May and June as indoor hospitality reopened and people dined out more.

Average basket sizes fell as fewer people did the ‘big weekly shop’ and the supermarkets reverted to promotions to attract customers. Prices were down a whopping 19% on average as almost 30% of grocery spending involved some kind of discount or deal.

Having struggled against their rivals last year through having no online ordering or delivery service, discounters Aldi and Lidl have outperformed this year and now hold a record 14.3% joint share of the market, putting them ahead of third-placed Asda with 14.1% of the market.

If anything, the pandemic and consumers’ focus on essential products – categories where the discount chains have always been strong – have opened the discounters up to an entirely new demographic.

According to GlobalData, the UK discount market could grow by more than a third over the next year to reach £32.5 billion of sales. That presents an enormous challenge to the Big Four supermarkets as well as to smaller rivals like Coop and Iceland.

AND THEN THERE WERE TWO?

CDR has until the close of business on 17 July to announce whether it will make a firm offer for Morrisons. If it does manage to buy Morrisons, investors will be left with a straight choice between market leader Tesco and runner-up Sainsbury.

Berenberg analysts comment that the Morrisons news should have a ‘positive readacross to the rest of the UK grocery space; the UK grocery sector’s relatively cheap valuations and cash generation may appear increasingly compelling to private markets’.

Tesco’s first quarter update was encouraging in as much as the internet shopping habit has stuck, with customers who are now used to ordering online ordering more frequently and the firm handling 1.3 million orders per week.

Also positive was the recovery in clothing and general merchandise as people gear up for the summer, while the Booker wholesale business benefitted from the reopening of the food service sector with sales up by more than two thirds on last year.

However, with little clarity on the outlook, in particular the possibility of more restrictions to halt the spread of new variants, chief executive Ken Murphy remained in cautious mood, sticking to his guidance that earnings would recover to pre-pandemic levels and no more.

Sainsbury publishes its first quarter results on 6 July, which if Kantar’s sales data is any guide should at least match Tesco in terms of growth, although it has a significantly smaller market share.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

magazine

magazine