Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

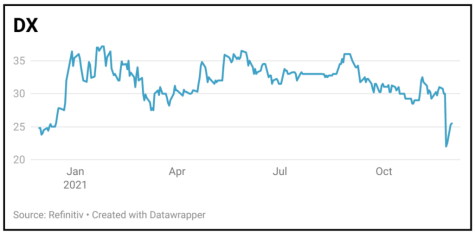

DX drops a clanger, prompting panic selling

AJ Bell is an easy to use, award-winning platform Open an account

We've accounts to suit every investing need, and free guides and special offers to help you get the most from them.

You can get a few handy suggestions, or even get our experts to do the hard work for you – by picking one of our simple investment ideas.

All the resources you need to choose your shares, from market data to the latest investment news and analysis.

Funds offer an easier way to build your portfolio – we’ve got everything you need to choose the right one.

Starting to save for a pension, approaching retirement, or after an explainer on pension jargon? We can help.

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

Like the rest of the market, we were completely blindsided by the announcement from DX (DX.:AIM) on the day of its annual general meeting last week that it couldn’t publish its annual report due to ‘a corporate governance inquiry’ raised by its audit and risk committee.

Investors headed for the hills and didn’t look back, selling the stock down as much as 40% at one point on more than 25 million shares, the biggest volume for over six months.

The firm said the inquiry related to an internal investigation begun during the financial year to the start of July, and until it was concluded the accounts couldn’t be signed off.

In all likelihood, that means the annual report won’t be ready before the start of January, at which point under AIM rules the shares will be suspended.

While we have no special insight into what has happened, we are at least comforted by the fact the firm’s operations appear to be unaffected and the outlook remains unchanged.

Meanwhile activist fund Gatemore, which owns 20.5% of the company, is asking for a seat on the board while both chairman Ronald Series and CEO Lloyd Dunn have been buying shares in a show of faith in the business.

SHARES SAYS: While we sympathise with the sellers, we would hold on for clarification.

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

The value of your investments can go down as well as up and you may get back less than you originally invested. We don't offer advice, so it's important you understand the risks, if you're unsure please consult a suitably qualified financial adviser. Tax treatment depends on your individual circumstances and rules may change. Past performance is not a guide to future performance and some investments need to be held for the long term.

magazine

magazine