A silver lining of the weak performance of Asian stocks in 2021 is it has pushed up dividend yields.

This is reflected in the yields available from UK-domiciled Asian income funds, some of which are running at 6%-plus.

The top performing fund on a three-year view is Schroder Asian Income Z Acc (B5BJ7M1), though it offers a more modest yield of 3.2%.

The excellent long-term track record is marked by strong protection against downside in choppy markets as well as less volatility.

Managed since its inception in 2006 by Richard Sennitt, he has more than 20 years experience investing in Asian stocks.

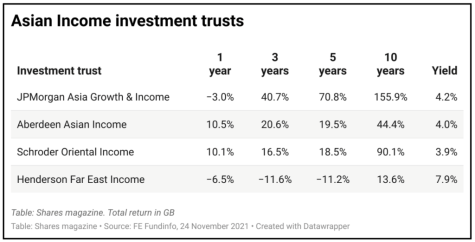

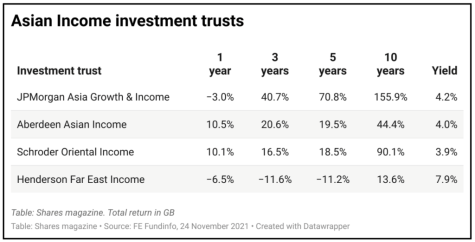

There are some particularly generous dividend yields available for Asian income investment trusts, which also have the ability to smooth out income by building up a cash buffer.

The highest yielder is the weakest performer Henderson Far East Income (HFEL) where a 7.9% yield is accompanied by a return which is less than a tenth of that of top-performing JPMorgan Asia Growth & Income (JAGI).

The latter still offers a decent yield in excess of 4%.

‹ Previous2021-12-02Next ›

magazine

magazine