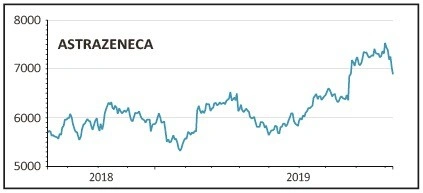

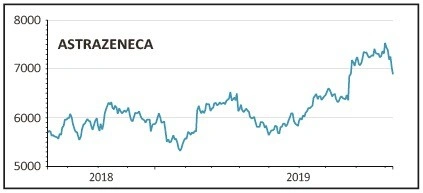

AstraZeneca (AZN) £68.57

Gain to date: 8.9%

Our positive call on pharmaceutical giant AstraZeneca (AZN) has performed solidly. However, having reached a record high on 2 September, boosted by positive news on drug trials, the shares have since lost some momentum and we think now would be a good time to take profit as sentiment towards names on lofty valuations sours.

Based on 2020 forecasts the shares trade on a price-to-earnings ratio upwards of 20-times and as broker Shore Capital recently noted, ‘the shares are priced to perform and (we) would anticipate a pullback on any minor setback’.

This setback came in the form of reports that US lawmakers are planning a legislative crackdown on prescription drug prices. Our ultimate 9% gain might not look much but you would have also enjoyed dividends in the interim, which was part of our rationale for flagging the company.

Fundamentally this remains a good business, and the firm’s oncology or cancer portfolio is continuing to perform well.

On 9 September it reported that results from a clinical trial showed its lung cancer drug reduced the risk of death by more than a fifth in patients with previously-untreated extensive-stage small cell lung cancer.

SHARES SAYS: We still like AstraZeneca just not at this price.

‹ Previous2019-09-12Next ›

magazine

magazine