Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

“The debate over the rights and wrongs of the bumper profits made by HSBC and BP will run and run but from the narrow perspective of investment their announcement of fresh multi-billion dollar share buyback schemes – topped up by a fresh programme at Ashtead – means that the FTSE 100 cash return bonanza continues,” says AJ Bell investment director Russ Mould.

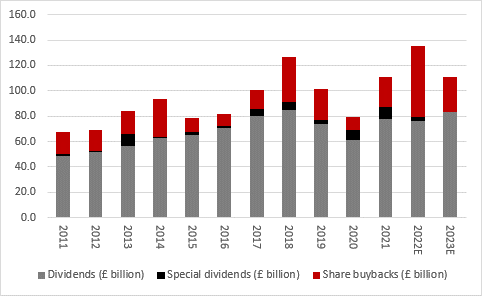

“Sentiment still seems lukewarm at best toward UK equities, despite the buybacks and rash of takeover deals, but the money keeps flowing. After this trio of announcements, FTSE 100 firms have announced plans to return £26.9 billion to their shareholders via buybacks this year.

“That figure supplements a forecast aggregate dividend pay-out of £83.6 billion for 2023 and comes on top of 2022’s all-time high for FTSE 100 buybacks of £55.8 billion. Whether the final total for 2023’s buybacks will match or exceed that of last year remains open to question, and much may depend on the trajectory of the global economy in the second half, but we are certainly off to a fast start.

Source: Company accounts. *2022 based on announcements to date

“Twenty-seven members of the FTSE 100 have announced or conducted share buybacks in 2023 to date, compared to 41 in 2022 overall.

“BP’s $1.75 billion second-quarter plan supplements outlays of $2.4 billion in Q1 (and $10 billion in 2022). HSBC’s $2 billion scheme adds to the $2.3 billion programme of 2022 and Ashtead, having returned $1 billion over the past two years is now buying back a further $500 million.

“Investors still seem a bit disappointed with BP’s forward guidance for buybacks and dividends for the rest of 2023, given how first-quarter cashflow was not quite so copious as before, thanks to lower fossil fuel prices and increased capital investment.

Source: Company accounts

“Even so, BP’s announcement also cements the oil and gas sector’s position at the top of the buyback charts, as ranked by industrial sector. This will doubtless make environmental campaigners despair, but it also may also mean their pleas for further windfall taxes resonate with politicians and the wider public alike, especially if oil or gas prices start to rally again (oil is down by a quarter and natural gas by 70%, based on the Brent crude and Henry Hub benchmarks, over the past year).

| Ten largest FTSE 100 firms for share buybacks | Share buybacks by sector | |||

|---|---|---|---|---|

| Share buybacks (£ billion) | 2023* | Share buybacks (£ billion) | 2023* | |

| BP | 3.9 | Oil & Gas | 7.1 | |

| Shell | 3.3 | Financials | 6.8 | |

| CRH | 2.5 | Consumer Staples | 4.1 | |

| Lloyds | 2 | Industrial goods & services | 3.8 | |

| HSBC | 1.6 | Consumer Discretionary | 3.1 | |

| Diageo | 1.4 | Mining | 1.2 | |

| Unilever | 1.3 | Utilities | 0.5 | |

| Glencore | 1.2 | Health Care | 0.1 | |

| Imperial Brands | 1 | Technology | 0.1 | |

| Standard Chartered | 0.8 | Telecoms | 0 | |

| Real estate | 0 | |||

| Total | 18.9 | Total | 26.8 | |

Source: Company accounts. *Announced to date

“This buyback largesse complements analysts’ forecasts for aggregate ordinary dividend payments from the FTSE 100 of £83.6 billion. That is a total of £110.4 billion and equivalent to 5.2% of the FTSE 100’s current total market capitalisation of £2.1 trillion.

Source: Company accounts, Marketscreener, analysts' consensus forecasts

“That is competitive when compared to the Bank of England base rate, or the yields available on UK government bonds, or gilts, although the danger remains that buyback plans are revised and dividend forecasts prove over-optimistic, should a recession or another unexpected development strike.

“Buybacks are particularly subject to revision, as there is far less stigma when a management team quietly parks a programme compared to when a boardroom has to sanction a dividend cut.

“In 2020, the current crop of FTSE 100 firms returned £9.8 billion to their shareholders via buybacks but scrapped plans to buy back £10.3 billion more as the pandemic spread, lockdowns were imposed and the globe plunged into a recession, to the great detriment of corporate profits, cash flows and in some cases balance sheets.

“Cynics will also flag how buybacks tend to be pro-cyclical. Buyback activity reached its high in 2006-07, as animal spirits were running most strongly just before the Great Financial Crisis swept the world. Over £60 billion in buybacks across those two years did nothing to support share prices in 2007-09 and buybacks slowed to just £3 billion in 2009 by the time the crisis was passing, and equity markets had collapsed and thus become much cheaper.

“Buybacks reached their next zenith in 2018 and the FTSE 100 topped out that year too, after setting what was then an all-time closing high of 7,779. Management teams’ record of buying high rather than low may give some investors pause for thought as to whether buybacks are a potential contrarian indicator.

“BP’s own track record here is not great. Its last major buyback spree of 2005-07 ran slap into the Great Financial Crisis and a collapse in the oil price from $147 to $35 by late 2008, while 2014’s buyback was followed by a two-year swoon in the price of crude from over $100 a barrel all the way down to $28.”

Source: Company accounts, Refinitiv data. *2022 announcements to date

Source: Refinitiv data

The case for and against share buybacks

“America’s Securities Exchange Act of 1934 outlawed share buybacks as it deemed large-scale share buybacks could be a form of wilful share price manipulation. That was only repealed in 1982 by the Reagan administration, with rule 10b-18, and since then buybacks have become increasingly popular. The UK has followed America’s lead to some degree here, although dividends are still the more common means for returning cash to investors.

“There are four clear arguments in favour of share buybacks.

- If a company is generating surplus cash, then it can return this money to shareholders and let them decide what to do with it, rather than splurge it on an unnecessary acquisition or capacity increases. This is a particularly acute issue at a time when interest rates remain low, even after some recent increases, and, as a result, firms are not gaining a substantial return on any cash holdings.

- Buybacks can work for individuals depending on their tax situation, and whether they prefer to be taxed on a capital gain (buyback) or dividend (income).

- Anyone who elects to retain their shares when a firm buys back stock will have an enhanced stake in the company and thus be entitled to a bigger share of future dividends (assuming there are any).

- Buybacks can also suggest that a management team feels a company’s shares are undervalued, so any move to buy back stock can be seen as a vote of confidence in the firm’s near and long-term trading prospects.

- History shows companies have a habit of buying stock back during bull markets (when their stock tends to be more expensive) and not doing so during bear ones (when their stock tends to be much cheaper). For example, buybacks in the US topped out in 2007 and collapsed in 2008 and 2009 only to reach new highs in 2018 as stock prices reached new peaks. A similar pattern can be seen in the UK and the higher share prices have gone, the more buybacks there seem to have been in 2021 and 2022 on both sides of the Atlantic.

- The tendency among some management teams to buy high rather than low could therefore question whether executives are sufficiently objective when they sanction a buyback to show the market they feel their stock is undervalued.

- A buyback could be used to massage earnings per share figures by reducing the share count at limited cost. This could be used to trigger management bonuses or stock options, courtesy of some near-term financial engineering.

- There is also the risk that some firms buy back stock using debt, potentially weakening their balance sheets and competitive position in the long term (although the same danger lurks with dividends).

“Any short-term financial engineering could therefore damage a firm’s long-term ability to invest in its customer proposition and defend its market share to the potential detriment of profits, cash flow, the ability to return cash and – ultimately – the share price.”

These articles are for information purposes only and are not a personal recommendation or advice.

Related content

- Wed, 24/04/2024 - 10:37

- Thu, 18/04/2024 - 12:13

- Thu, 11/04/2024 - 15:01

- Wed, 03/04/2024 - 10:06

- Tue, 26/03/2024 - 16:05